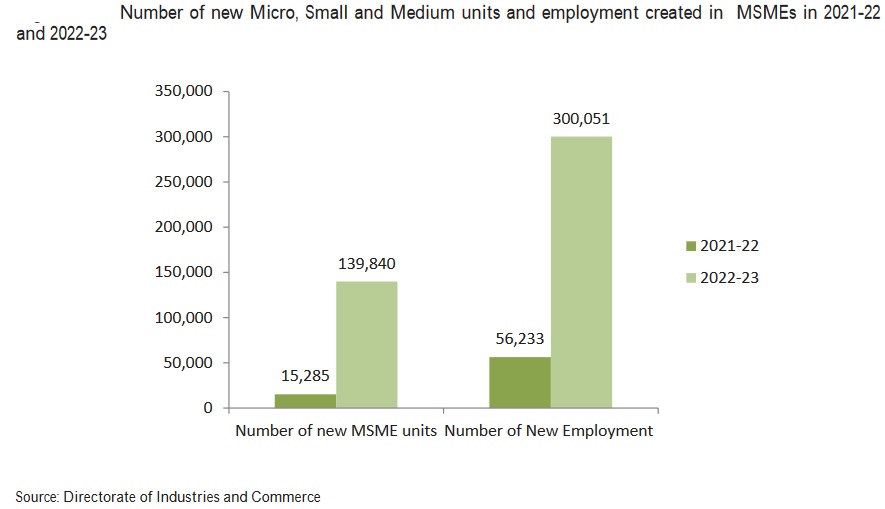

The State achieved remarkable surge in the number of new MSME units established in 2022-23. A total of 1,39,840 new MSME units were set up in 2022-23 with investment of Rs 8,421.63 crore, registering an increase of about 449 per cent over previous year. These units have created employment opportunities for 3,00,051 individuals, registering about 244 per cent increase over previous year. Such a massive expansion in the MSME sector is an encouraging sign for the State’s economy and a testament to its potential for growth and development. The details of new MSME units for the last five years are given below:

|

Achievement in MSME sector, 2017-18 to 2022-23 (As on August 31, 2023)

|

|

Year

|

No. of MSME Units

|

Investment

(Rs in crore)

|

Employment

(in number)

|

|

2017-18

|

15,468

|

1,249.61

|

51,244

|

|

2018-19

|

13,826

|

1,321.94

|

49,068

|

|

2019-20

|

13,695

|

1,338.65

|

46,081

|

|

2020-21

|

11,540

|

1,221.86

|

44,975

|

|

2021-22

|

15,285

|

1,535.09

|

56,233

|

|

2022-23

|

1,39,840

|

8,421.63

|

3,00,051

|

|

Total

|

2,09,654

|

15,089.62

|

5,47,652

|

|

Source: Directorate of Industries and Commerce

|

The number of new MSME units and employment provided for the last two years is shown below:

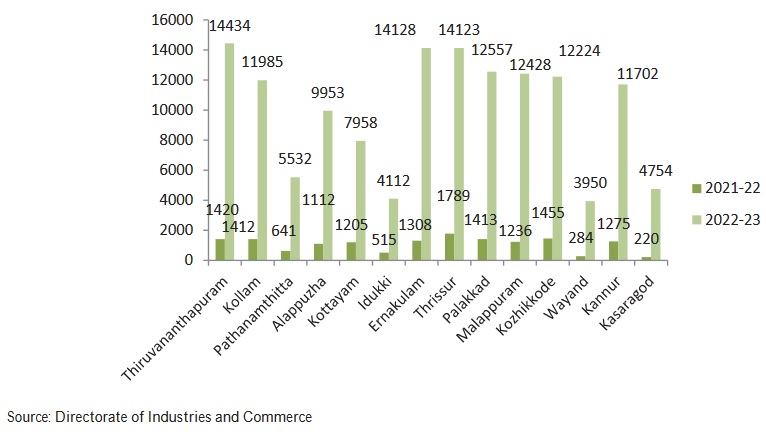

In 2022-23, the district with the largest numbers of new MSME units was Thiruvananthapuram (14,434 units) with an investment of Rs 840.89 crore, generating 29,878 employment opportunities, followed by Ernakulam (14,128 units) with an investment of Rs 1,172.46 crore generating 33,765 employment opportunities and Thrissur (14,123 units) with an investment of Rs 752.42 crore providing employment to 29,536 persons. Wayanad (3,950 units) had the lowest number with an investment of 236.58 crore generating employment for 8,234 persons. The district-wise details of new MSME units started in Kerala in 2022-23 is given below:

|

District wise details of new MSME units started in Kerala in 2022-23

|

|

Sl. No

|

State \ District

|

No of MSME units started

|

Total Investment (Rs in crore)

|

Employment generated (Nos)

|

|

1

|

Thiruvananthapuram

|

14434

|

840.89

|

29878

|

|

2

|

Kollam

|

11985

|

622.58

|

24449

|

|

3

|

Pathanamthitta

|

5532

|

257.53

|

11478

|

|

4

|

Alappuzha

|

9953

|

527.58

|

21213

|

|

5

|

Kottayam

|

7958

|

438.24

|

16603

|

|

6

|

Idukki

|

4112

|

232.46

|

8519

|

|

7

|

Ernakulam

|

14128

|

1172.46

|

33765

|

|

8

|

Thrissur

|

14123

|

752.42

|

29536

|

|

9

|

Palakkad

|

12557

|

674.56

|

27729

|

|

10

|

Malappuram

|

12428

|

812.07

|

28818

|

|

11

|

Kozhikode

|

12224

|

856.93

|

26495

|

|

12

|

Wayanad

|

3950

|

236.58

|

8234

|

|

13

|

Kannur

|

11702

|

698.47

|

23905

|

|

14

|

Kasaragod

|

4754

|

298.86

|

9429

|

|

Total

|

139840

|

8421.63

|

300051

|

|

Source: Directorate of Industries & Commerce

|

In 2021-22, Thrissur was the district with the largest number of new units (1,789 units) generating 5,200 jobs, followed by Kozhikode with 1,455 units generating 4,738 jobs and Palakkad with 1,413 MSME units with 5,850 jobs. Kasaragod (220 units) had the lowest number with an investment of 17.09 crore generating employment for 959 persons. District-wise details of new MSME units in the State in 2021-22 and 2022-23 is given below:

The sector-wise growth of MSME units over the last five years reveals an increase in the number of agro and food-based units from 2,712 in 2018-19 to 23,474 in 2022-23. The number of service related MSME units has increased from 3,259 in 2018-19 to 26,159 in 2022-23. The subsector -wise details of MSME units started in the last five years is given below:

Sub-sector-wise details of new MSME units started in Kerala

|

Name of Subsector

|

2018-19

|

2019-20

|

2020-21

|

2021-22

|

2022-23

|

|

Agro and Food-based

|

2712

|

2,582

|

3359

|

4297

|

23,474

|

|

Textiles and Garments

|

1858

|

1,904

|

1276

|

1564

|

14,702

|

|

General/mechanical/light Engineering

|

1533

|

1,334

|

959

|

1193

|

1,988

|

|

Service Activities

|

3259

|

4,036

|

2725

|

4097

|

26,159

|

|

Wood Products

|

644

|

5,32

|

436

|

517

|

1,529

|

|

Cement Products

|

329

|

3,09

|

233

|

368

|

0

|

|

Printing and Allied

|

348

|

2,80

|

188

|

198

|

3,795

|

|

Paper Products

|

192

|

1,88

|

198

|

234

|

659

|

|

Information Technology

|

294

|

2,40

|

187

|

348

|

6,091

|

|

Trade activity

|

-

|

-

|

-

|

-

|

48,945

|

|

Others

|

2657

|

2,290

|

1949

|

2469

|

12,498

|

|

Total

|

13,826

|

13,695

|

11,540

|

15,285

|

1,39,840

|

|

Source: Directorate of Industries and commerce

* From 2022-23 onwards the data of trade activity included

|

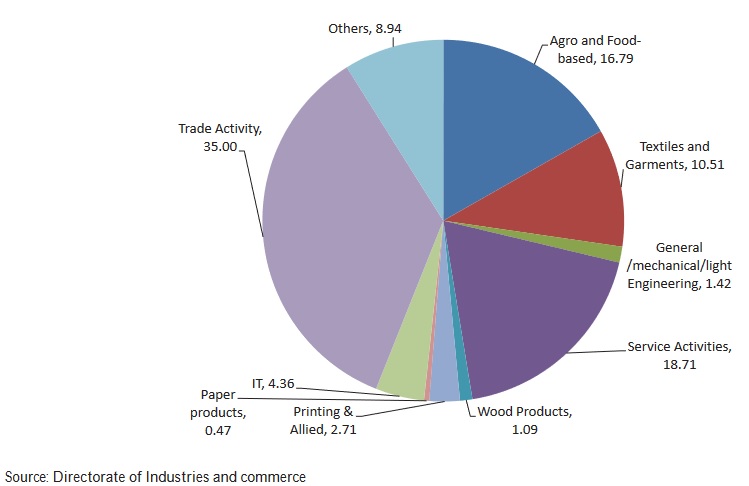

The top five subsectors together consist of over 80 per cent of the MSME units in the last five years. Trade Activity based units (35%), Agro and food based (17%) units and Service Activities (19%) dominate in MSMEs. Units making plastic containers, gold ornaments, rubber products, handicrafts products are classified as “Others” (9%). Textiles and garments (10%), Information Technology (4%) and General/Mechanical/Light Engineering (1%) are the other leading subsectors. The share of each subsector is given below:

Subsector wise details of new MSME units in 2022-23

Export

Cashew:

India is among the largest cashew producing countries in the world. It employs large number of workers in the farms and factories. India exports cashews to more than 60 countries. As per the Directorate General of Commercial Intelligence and Statistics, the quantity of cashew export for India in 2022-23 is 76,824.69 MT and value is Rs 2,98,219.37 lakh. This was 80,366.25 MT and Rs 3,40,991.42 lakh in the previous year. This is (-) 5.59 per cent fall in quantity export and (-) 12.54 per cent fall in value exported.

Cashew cultivation spreads along the coastal regions of peninsular India. Kerala is an important player in cashew production, processing and export. Cashew processing industry was earlier concentrated in Kollam, but now it spread across many States in India. The export of cashew kernels from Kerala was 21,858 MT in 2022-23. It registers a negative growth of (-) 10.05 per cent in volume from 24,299 MT in 2021-22.

Export of cashew kernels, Kerala and India, 2015-16 to 2022-23, in Rs crore

|

Year

|

Kerala

|

India

|

Share of Kerala (%)

|

|

Quantity

(MT)

|

Value

(Rs crore)

|

Quantity

(MT)

|

Value

(Rs crore)

|

Quantity

|

Value

|

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

|

2015-16

|

50,652

|

2,579.5

|

96,346

|

4,952.1

|

52.6

|

52.1

|

|

2016-17

|

38,054

|

2,415.3

|

82,302

|

5,168.8

|

46.2

|

46.7

|

|

2017-18

|

36,930

|

2,580.4

|

84,352

|

5,871.0

|

43.8

|

44.0

|

|

2018-19

|

29,062

|

1,892.6

|

66,693

|

4,434.0

|

43.6

|

42.7

|

|

2019-20

|

30,478

|

1,742.5

|

67,647

|

3,867.2

|

45.1

|

45.1

|

|

2020-21

|

*23,368

|

NA

|

49992

|

2907

|

46.7

|

NA

|

|

2021-22

|

*24,299

|

NA

|

53770

|

3175.2

|

45.2

|

NA

|

|

2022-23

|

*21,858

|

NA

|

|

|

|

|

|

Source: Cashew Export Promotion Council of India /*Cochin Port Trust

|

The export of cashew nuts kernel whole and dried nuts contribute 58,593.52 MT of export volume and Rs 2,82,030.19 lakh value in 2022-23. This was 73,560.50 MT in 2021-22 with value of Rs 3,29,902.10 lakh. The export of cashew nut shell liquid from India shows an increasing trend in 2021-22, although the growth in export of other items are not promising. There is no export of nut shell liquid from Kerala since 2020-21.

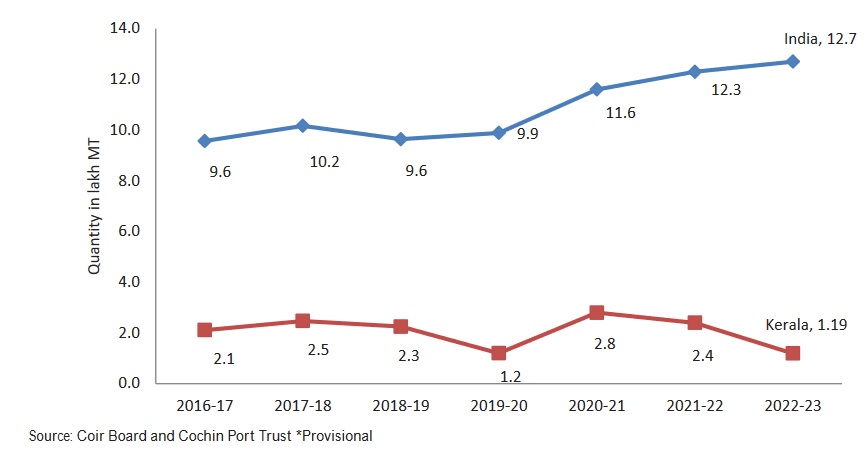

Export of Coir and Coir Products

The export of coir and coir products from India is 12,64,784 MT in volume and Rs 3,992.17 crore in value. This is a 2.85 per cent growth over the previous year’s export of 12,34,855 MT of coir and coir products. The export of coir and coir products from Kerala through Cochin Port showed a declining trend in 2022-23. The quantity exported through Cochin Port in 2022-23 was 1,19,350 MT and recorded a negative growth of 50.42 per cent over the previous year. The export of coir and coir products through Cochin Port in 2021-22 was 2,40,745 MT. Export trend of coir and coir products from India and Kerala is given below:

Export trend of coir and coir products from India and Kerala (through Cochin Port),

2016-17 to 2022-23, quantity in lakh MT

Export of Tea:

Export of tea from Kerala ports in 2022-23 is 68.88 MT worth Rs 1,511.11 crore from 66.86 MT worth Rs 1,515.16 crore in 2020- 21 registering a growth of 3.02 per cent in terms of quantity and (-) 0.27per cent in terms of value. The details are given below:

Export of tea from Kerala ports and India, 2018-22, quantity in MT, Rs In Crores

|

Year

|

India

|

Kerala

|

|

Qty

|

Value

|

Qty

|

Value

|

|

2018

|

256.06

|

5,335.33

|

81.72

|

1,386.14

|

|

2019

|

252.15

|

5,737.66

|

79.74

|

1,530.28

|

|

2020

|

209.72

|

5,235.29

|

70.96

|

1,515.30

|

|

2021

|

196.54

|

5,311.15

|

66.86

|

1,515.16

|

|

2022*

|

226.98

|

6,253.19

|

68.88

|

1,511.11

|

|

Source: Tea Board * Provisional; subject to revision

|

Export of Coffee:

The export of coffee from Kerala through Cochin port in 2022-23 was 53291MT and Rs 1.16 lakh in value. This shows a fall in quantity exported by (-) 29.54 per cent and fall in value by (-)10.81 per cent, in 2022-23 compared to the previous year.

Export of Spices:

In 2022-23, the export of spices and spice products from India was 14,04,357 MT valued Rs 31,761.38 crore as compared to 15,30,661 MT valued Rs 30,324.32 crore. This registers a decline of 8.25 per cent in volume and an increase in value by 4.74 per cent. The export of spices from Kerala in 2022-23 was 1,11,080.13 MT and value of export was Rs 5,51,521.02 lakh. This shows a decrease in quantity traded by 10.09 per cent and value by 2.67 per cent over the previous year.

Export of spices, India and Kerala, from 2016-17 to 2022-23, quantity in MT and value in ₹ lakh

|

Year

|

Kerala

|

India

|

Kerala’s share (%)

|

|

Quantity

(in MT)

|

Value

(Rs lakh)

|

Quantity

(in MT)

|

Value

(Rs lakh)

|

Quantity

|

Value

|

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

|

2016-17

|

84,418.8

|

4,27,120.1

|

9,47,790

|

17,81,223.6

|

8.9

|

24.0

|

|

2017-18

|

95,455.9

|

4,15,296.1

|

10,28,060

|

17,98,016.2

|

9.3

|

23.1

|

|

2018-19

|

89,590.8

|

3,78,560.4

|

11,00,250

|

19,50,581.1

|

8.1

|

19.4

|

|

2019-20

|

1,00,195.8

|

4,05,421.3

|

12,08,400

|

22,06,280.0

|

8.3

|

18.4

|

|

2020-21

|

1,21,348.9

|

5,00,633.6

|

17,58,266

|

30,96,771

|

6.9

|

16.2

|

|

2021-22

|

1,23,547.93

|

5,66,643.6

|

15,30,661

|

30,32,432.4

|

8.1

|

18.5

|

|

2022-23*

|

1,11,080.13

|

5,51,521.02

|

14,04,357

|

31,76,138.2

|

7.9

|

17.36

|

|

Source: Spices Board *Provisional

|

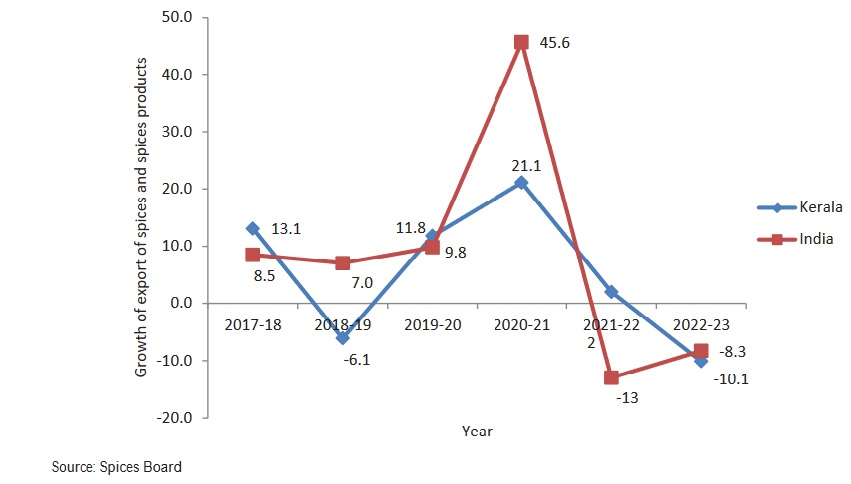

Kerala’s export of spices and spice products, in quantitative terms, showed an increasing trend in 2019-20 and 2020-21. It continued positive in 2021-22, although declined the growth rate from the previous year. The year 2022-23 registered a negative growth of (-) 10.1 for Kerala. Indian trend for spices export continued to be negative for two consecutive years and remained (-) 8.3. Figure 5.4.7 depicts the trend in growth of export of spices and spice products from India and Kerala.

Trend in growth of export of spices and spice products from India and Kerala, 2017-18 to 2022-23, quantity in per cent

In 2022-23, the export of individual spices like chilli, cardamom (small), ginger, cumin, celery, fenugreek from Kerala showed decrease both in volume as compared to previous year. A total volume of 1,345 MT of cardamom (small) valued Rs 500.02 crore was exported from Kerala in 2022-23 as against 5,825 MT valued Rs 800.05 crore in 2021-22. Export of chilli 25,717 MT valued Rs 659.70 crore in 2022-23 shows a decrease from 30,225 MT valued Rs 650.97 crore from the previous year. The export of pepper was declined to 12,491 MT valued Rs 572.21 crore in 2022-23 as against 17,248 MT valued Rs 602.98 crore in 2021-22.

In the case of value-added products export of curry powder and mixture showed an increase in volume and value while spice oil and oleoresins products showed marginal decline in 2022-23 in terms of quantity as compared to 2021-22. Export of curry powder and mixture in 2021-22 was 15,284 MT valued Rs 314.79 crore and which rose to 17,505 MT valued Rs 408.60 crore in 2022-23 recording an increase in volume and value of export. Spice oils and oleoresins valued Rs 2,444.56 crore was exported in 2021-22 which declined to Rs 2,365.42 crore in value.